What is Warren Buffett Net Worth?

Warren Buffett Net Worth is US$ 115.6 Billion as of July 2023.

| Net Worth | US$ 115.6 Billion |

| Born: | August 30, 1930 (94 Years) |

| Birth Name | Warren Edward Buffett |

| Gender | Male |

| Height | 5′ 10″ (1.78 m) |

| Horoscope | Virgo |

| Country of Origin | The U.S. |

| Source of Wealth | Chairperson of Berkshire Hathaway |

| Marital Status | Married |

| Spouse | Astrid Menks (m. 2006) Susan Thompson (m. 1952; died 2004) |

| Children | Susan Alice Buffett (Daughter), Howard Graham Buffett (Son), Peter Buffett (Son) |

| Famous For | Oracle of Omaha |

Table of Contents

Biography

Warren Buffett an American investor, business magnate, and philanthropist. He is regarded as the most significant and successful investor worldwide. Since 1970, Buffett has been chairman and largest shareholder at Berkshire Hathaway. He’s also one of the wealthiest people in the world. Warren was a white knight at large during the recession of the late 2000s. He saved Goldman Sachs and General Electric while refusing to be rescued by Lehman Brothers Holdings. In 2009, he made a significant bet on America’s economy by buying Burlington Northern Santa Fe at $34 billion. His net worth exceeds $118 billion as of January 2023, which makes him the sixth-wealthiest person in the world.

Timeline

Early Life

Warren Buffett was born on August 30, 1930, in Omaha. He is the second of three siblings; he started his education at Rose Hill Elementary School. His father was elected in 1942 to the first four terms of the United States Congress. Warren moved to Washington, D.C., with his family. He attended elementary school, graduated from Alice Deal Junior High School in 1947, and then went to Woodrow Wilson High School.

After completing high school and succeeding in his investment and entrepreneurial ventures, Buffett decided to leave college and go straight into business, but his father used to overrule him. Buffett was enrolled at the Wharton School of the University of Pennsylvania in 1947. He moved to Nebraska and received a Bachelor of Science in Business Administration. Buffett had hoped to attend Harvard Business School. However, he was denied admission. Later, Buffett enrolled in Columbia Business School. Columbia University awarded him a Master of Science degree in Economics in 1951.

Career

Once graduating from Columbia University, he worked as a financing broker for Buffett-Falk & Co. He started giving training on “Investment Principles” and thought of putting money into a gas station, but he lost the gas station. However, Benjamin Graham, a respected businessman, and investor, was attracted to his business acumen. Graham is also one of Buffet’s former professors. Buffett moved to Graham-Newman Corp. as a safekeeping analyst. Buffett learned much from Graham over his four years of employment. But he also recognized that he was more likely to take on risk as an investment analyst than his chief. Buffett bought almost $174,000 he would be saved at Graham-Newman to start Buffett Partnership Ltd. In the three years that followed, he developed his company from three partners to six. In the two years that followed, the number was almost twice. By 1962, Buffett was a genuine millionaire.

Buffett started a series of aggressive investments, takeovers, and restructuring moves after he took over Berkshire Hathaway’s textile manufacturing company. Buffett established his reputation as an investor to be followed. Warren seemed to have everything in his grasp. He could buy stock in unrecognized companies and ride the rise in their treasures to greater profits. His company traded at $775 in 1979 and had shares of $1310 by the end of the year. He was worth $620 million by the time he retired in the early 1980s. He bought stock in many businesses, counting the Washington Post Company and Capital Cities. The Salomon Brothers were his most successful business as the Coca-Cola Company. He was a tycoon by 1990. His shares in Berkshire Hathaway were valued at $7,175 each.

Buffett is known for his investment in products that he consumes. He holds Fruit of the Loom for the sample because he loves their underwear and shirts. Warren became famous when his love for a particular suit brand led to him investing in Trands Co, a Chinese company. The brand is loved by many, including Hu Jintao, the former Chinese President, and Bill Gates, the billionaire. Berkshire Hathaway, the CEO of financial powerhouse Berkshire Hathaway, also created a video to celebrate the 30th anniversary of the apparel company. They were able to chat about their nine Trands suits.

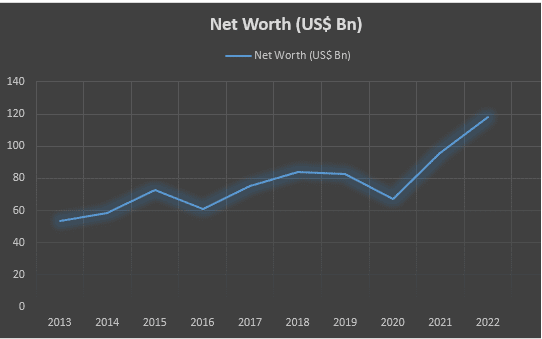

Warren BuffettNet Worth Growth

A small description of how Warren Buffett’s net worth grew over the past years

| Net Worth in 2022 | US$ 118 Billion |

| Net Worth in 2021 | US$ 96 Billion |

| Net Worth in 2020 | US$ 67.5 Billion |

| Net Worth in 2019 | US$ 82.5 Billion |

| Net Worth in 2018 | US$ 84 Billion |

| Net Worth in 2017 | US$ 75.6 Billion |

| Net Worth in 2016 | US$ 60.8 Billion |

| Net Worth in 2015 | US$ 72.7 Billion |

| Net Worth in 2014 | US$ 58.2 Billion |

| Net Worth in 2013 | US$ 53.5 Billion |

Warren Buffett’s net worth was US$ 53.5 bn in 2013, which was increased to US$ 118 billion in 2022.

Highlights

Here are some of the best highlights of Warren Buffett’s career:

- Warren took control over Berkshire Hathaway in 1965.

- Became Chairman and CEO of Berkshire Hathaway in 1970.

- Berkshire acquired 6.3% of Coca-Cola in 1989.

- Berkshire took complete control of GEICO in a $2.3 billion deal in 1996.

- Wrote a Carol J. Loomis, Tap Dancing to Work: Warren Buffett on Practically Everything, 1966–2012: A Fortune Magazine Book.

Favorite Quotes from Warren Buffett

“The best chance to deploy capital is when things are going down.”

– Warren Buffett

“Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future.”

– Warren Buffett

“Don’t pass up something that’s attractive today because you think you will find something better tomorrow.”

– Warren Buffett

“Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.”

– Warren Buffett

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

– Warren Buffett

Key Life Lesson from Warren Buffett

Now we have an overview of Warren Buffett’s net worth, work done, biography, and early life.

Let’s glance at some of his lessons.

Invest in companies that you understand.

You should never again shake hands with the same person if you only get four fingers back from someone you have shaken hands with.

Be fearful when others are greedy, and be greedy when others are fearful.

It is time to be cautious, as many companies are attractive based on their past returns. Even the market sentiment is positive, and many investors are willing to invest.

Frequently Asked Questions

Warren Buffett earns an estimated salary of $8 Billion Per Year.

Warren Buffett has announced that he will donate 99% of his wealth to charity after his death.

Warren Buffett has invested in many companies few of them are listed: Bank of America (BAC) and Kraft Heinz (KHC), as well as Coca-Cola (KO) and American Express (AXP).

Summary

Warren Edward Buffett is an American business magnate, investor, and philanthropist who is the chairman and CEO of Berkshire Hathaway and one of the world’s wealthiest people. He is known as the “Oracle” or “Sage” of Omaha and is renowned for his loyalty to value investing and personal thrift. Buffett is also a philanthropist, having vowed to give away 99% of his wealth and initiated The Giving Pledge in 2010 with Bill Gates. The estimated net worth of Warren Buffett is 115.6 Billion as of July 2023.

What do you think about Warren Buffett’s net worth? Leave a comment below.

Reader Interactions