What is Ken Griffin Net Worth?

Ken Griffin net worth is US$ 35 Billion as of Jan 2023.

| Net Worth | US$ 35 Billion |

| Born: | October 15, 1968 (55 Years) |

| Full Name | Kenneth Cordele Griffin |

| Gender | Male |

| Height | 6’ 0” |

| Horoscope | Libra |

| Country of Origin | Daytona Beach, Florida, The US |

| Source of Wealth | Entrepreneurship, Hedge Fund Manager |

| Marital Status | Unmarried |

| Spouse (s) | Anne Dias-Griffin (M., 2003; Div.,2015), Katherine Weingartt (M., Not Available; Div., 1996) |

| Famous For | Founder of Citadel LLC and Citadel Securities |

Table of Contents

Biography

Kenneth Cordele Gryphon is an American hedge fund manager, business owner, and investor born on October 15, 1968. He is the company’s founder, CEO, co-chief investment officer, and 80% owner of the global hedge fund Citadel LLC. One of the biggest market makers in the US, Citadel Securities, is another company he owns.

As of April 2023, Griffin has an estimated net worth of US$ 35 billion, making him the 38th-richest person in the world. He was placed 21st on the 2022 Forbes 400 list of richest Americans. According to Forbes’ 2023 list of America’s Most Generous Givers, he donated US$ 1.56 billion to various charitable causes, especially in education, economic mobility, and medical research. He was listed as one of these people.

Timeline

Early Life

Griffin was born on October 15, 1968, in Daytona Seaside, Florida, the offspring of a construction supplies executive. Griffin’s father had various positions and was an endeavor boss for General Electric. Griffin experienced adolescence in Boca Raton, Florida, with some time in Texas and Wisconsin. He went to focus school in Boca Raton, followed by Boca Raton Social Class Optional School, where he was the head of the number-related club. In addition, Griffin ran a discount mail-demand preparing programming firm in an optional school out of his room called EDCOM.

In a 1986 article in the Sun-Sentinel, Griffin communicated that he figured he would transform into a monetary trained professional or legitimate guide and acknowledged that the work market for programmers would essentially reduce over the oncoming decade.

Career

Kenneth C. Griffin is the Organizer and CEO of Bastion, a worldwide elective venture company. Ken started exchanging from his apartment at Harvard in 1987, introducing a satellite dish on the rooftop to get continuous stock statements.

After three years, he established Fortress, trusting that the mix of extraordinary ability, progressed quantitative investigation, and driving edge innovation would produce severe strength areas for predictable-term execution.

Today, the firm is perceived as one of the best elective venture companies on the planet, contributing in the interest of capital accomplices that incorporate transcendent public, private, and non-benefit organizations. In 1990, Griffin established Stronghold with US$ 4.6 Billion. By 1998, Stronghold had developed into more than 100 representatives and US$ 1 billion in speculation capital.

In June 2002, Griffin was remembered for CFO Magazine’s Worldwide 100, a rundown of the most compelling individuals in money. Griffin has seemed various times in’s Forbes 400, first in 2003, with expected total assets of US$ 650 Billion. At 34, he was the most youthful, independent person on the rundown. In September 2004, Fortune magazine positioned Griffin, 35 that year, as the eighth most extravagant American under forty in the classification of independent, US-based riches.

In 2006, Griffin was the fifth most youthful of the seven individuals younger than 40 recorded on the Forbes 400. In 2007, Griffin had expected total assets of US$ 3 billion. By 2014, Griffin’s total assets were assessed at US$ 5.5 billion.

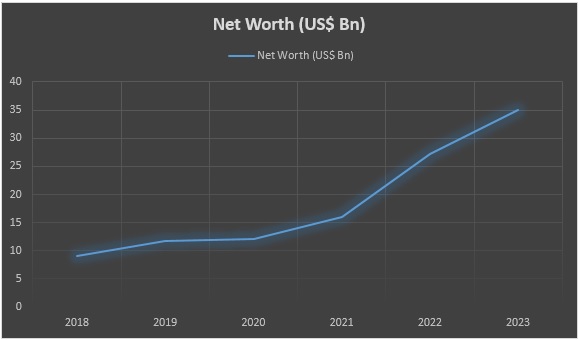

Net Worth Growth

Ken Griffin’s net worth has grown over the past years. In 2018 it was US$ 9 Billion, and now in 2023, it is US$ 35.0 Billion.

| Net Worth in 2023 | US$ 35.0 Billion |

| Net Worth in 2022 | US$ 27.2 Billion |

| Net Worth in 2021 | US$ 16.0 Billion |

| Net Worth in 2020 | US$ 12.1 Billion |

| Net Worth in 2019 | US$ 11.7 Billion |

| Net Worth in 2018 | US$ 9.0 Billion |

Highlights

- CEO of Citadel

- Griffin was the youngest self-made individual on the Forbes 400 (2003)

Favourite Quotes from Ken Griffin

“Almost all politicians can have a great one-on-one meeting. But I’m not interested in the candidate who can have a great meeting. I’m interested in a person who can make the right decisions.”

– Ken Griffin

“Every organization has two choices. Choice one is to grow. Choice two is to die. If you decide not to grow, it’s a clear-cut message to talented people that it’s time to leave.”

– Ken Griffin

“In some industries, we refer to risk-taking as’ research and development.’ At financial institutions, we often take the risk by investing in securities.”

– Ken Griffin

“We’re subject to the same forces of capitalism that have built the American economy. Strong returns induce more capital flow, which creates more competitors, and you have to evolve and get better, or you die.”

– Ken Griffin

“We don’t have a good legal justification for breaking up the banking system. But if I could wave a magic wand, I’d break up the banking system.”

– Ken Griffin

“When a company creates a product that directly or indirectly adversely impacts people’s health, that product must be regulated. The process by which it is created must be regulated. No company has the right to injure people. No company.”

– Ken Griffin

Keys Life Lessons from Ken Griffin

We now know everything about Ken Griffin and his net worth. Let’s look at some of his lessons.

1. Begin as Soon as possible

Ken Griffin began his trading company when he was an undergrad in 1987. Begin as soon as possible if you fantasize about becoming wildly successful in the monetary market. Regardless of whether you have simply $1000, you can begin now! As your standing develops, you will then draw in more cash.

2. Misfortunes Are Inescapable

In the monetary market, you will make misfortunes now and again, which is unavoidable. All financial backers have made their misfortunes previously. How you adjust to the misfortunes matters. Up to this point, Ken Griffin has previously recuperated from his misfortunes, and his asset is improving over ever.

3. Adjust to Change

In any profession way you follow, change is unavoidable. Assuming you get into exchanges or speculations, you will observe that the business is very change-situated. Adjusting to change will assist you with improving as a dealer.

Frequently Asked Questions

Ken Griffin’s net worth was estimated at US$ 35 Billion as of Jan 2023.

Ken Griffin’s First wife was Katherine Weingartt, and his second wife was Anne Dias-Griffin.

Ken Griffin will be 54 in 2023, as his birth year is 1968.

Summary

Ken Griffin established and ran Bastion, a Miami-based mutual funds firm that generally oversees $57 billion in resources. He founded Bastion in 1990 yet initially started exchanging from his Harvard quarters in 1987. He put a satellite dish on the rooftop to get continuous stock statements. Ken Griffin is the pioneer behind Stronghold Protections, one of Money Road’s most excellent market-production firms, answerable for one of every five stock exchanges in the U.S. Griffin managed a $2 million gift from Citadel and Citadel Securities to Weill Cornell Medication to assist with financing the improvement of better approaches to shield individuals from Coronavirus and to distinguish new instances of the sickness.

Ken Griffin made his most memorable passage in Forbes 400 of 2003 and was the most youthful in the rundown at age 34. He has just made fresher and undeniably more amazing records after that. The independent, wealthy person has confidence in two corporate ideas, initial, one being that the best venture must be workers and that investors ought to play a more significant part in the administration of the organization and that there ought to be.

What do you think about Ken Griffin net worth? Leave a comment below.

Reader Interactions